Decentralized finance, or DeFi, has been growing at an outstanding rate since late 2017. The majority of these protocols are built on the Ethereum network and continue to dominate its gas usage. These DeFi protocols enable lending, derivatives, exchanges, gambling, and payments without a central authority (or that’s the goal). The emergence of DeFi in late 2017 and into 2018 has, in my opinion, saved the Ethereum network by giving it a second mainstream application outside ICO’s (the first being stable coins). Many, if not all, of these DeFi protocols are currently centralized in some way or another with the end goal of being completely decentralized. For now, they should be referred to as permissions finance, or PeFi, because the ability of their ability to provide any user on the planet access to services no matter their geographic location, local regulation and laws, credit history, or occupation.

Below are my go-to resources for DeFi data, visualization, stats, and API points. This page was last updated on 3/31/2020 and will be continually updated to add new resources, remove broken links, etc.

General DeFi Statistics and Visuals

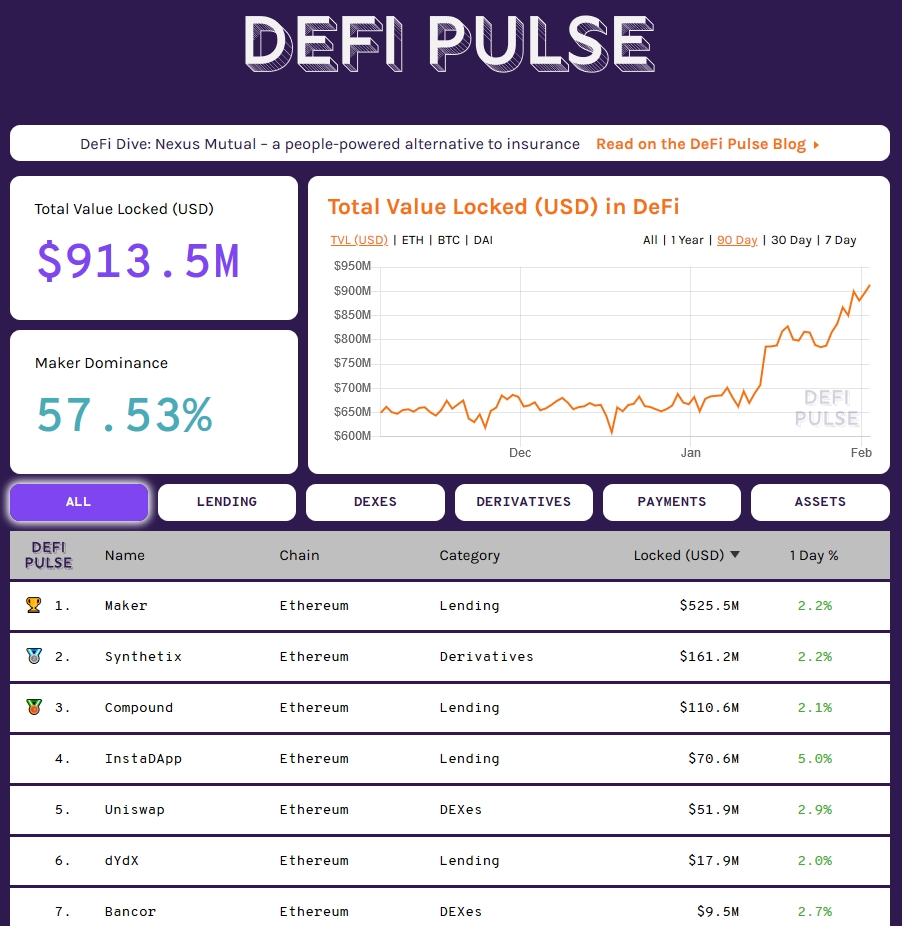

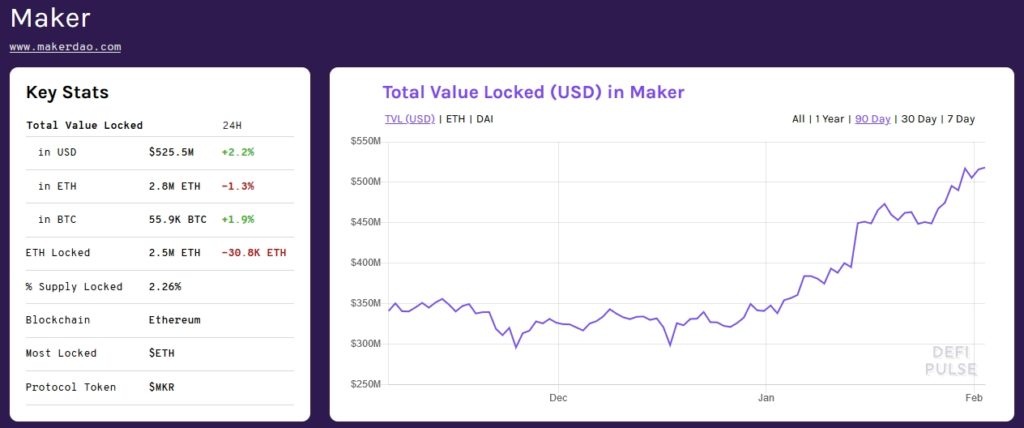

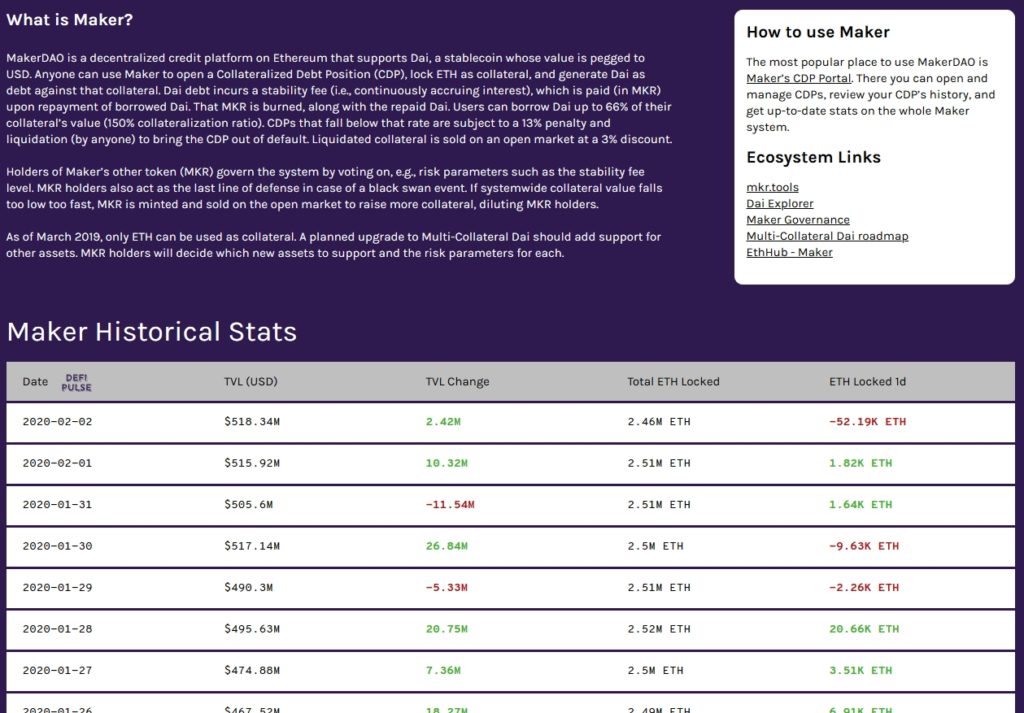

DeFi Pulse (DeFipulse.com)

DeFi Pulse is an excellent resource and starting point when looking for high level DeFi data. The total value “locked” data point displays the total number of Bitcoin, Ethereum, or DAI being used in the DeFi ecosystem. This data tracked and charted for lending, derivative, payments, exchange, and asset protocols on Ethereum.The homepage lists all of the protocols and their ranking by total value locked. The individual protocol pages have key growth stats, simple charts, a summary of the application and relevant links. The DeFi list page has a complete set of resources ranging from projects, wallets, interfaces, newsletters, and podcasts.

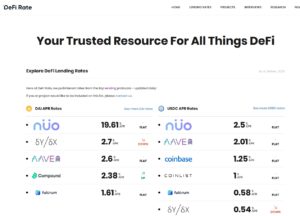

DeFi Rate(DeFirate.com)

Similar to DeFi Prime, DeFi Rate provides lending and borrowing rates across all of the popular protocols including Aave, Compound, Curve, Dharma, Maker, and Nuo Network. The projects section breaks down the DeFi space by lending, DEXs, derivatives, asset management, wallets, insurance, and more. This is a good starting point for users looking to learn about DeFi projects, read reviews, and stay up to date with the latest changes.

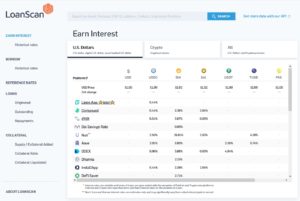

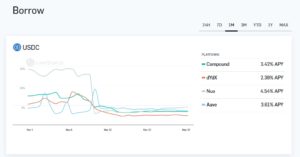

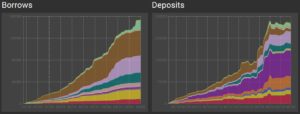

LoanScan (Loanscan.io)

LoanScan provides financial information for DeFi protocols. Current interest and borrow rates for Compound, dYdx, Dharma, Maker DAO, Nuo, Aave, DDEX, and available to view in a simple table. Rates for centralized services such as BlockFi and Nexo are also displayed. It serves as legitimate starting point when looking for high level rates and analytics for USD, USDC, USDT, DAI, SAI, TUSD, PAX, and GUSD.

Loanscan also provides historical rates, loan details (originated, outstanding, repayments), and collateral details (supply, ratio, liquidations) for MCD, Compound, and DyDx. The free API documentation can be found here.

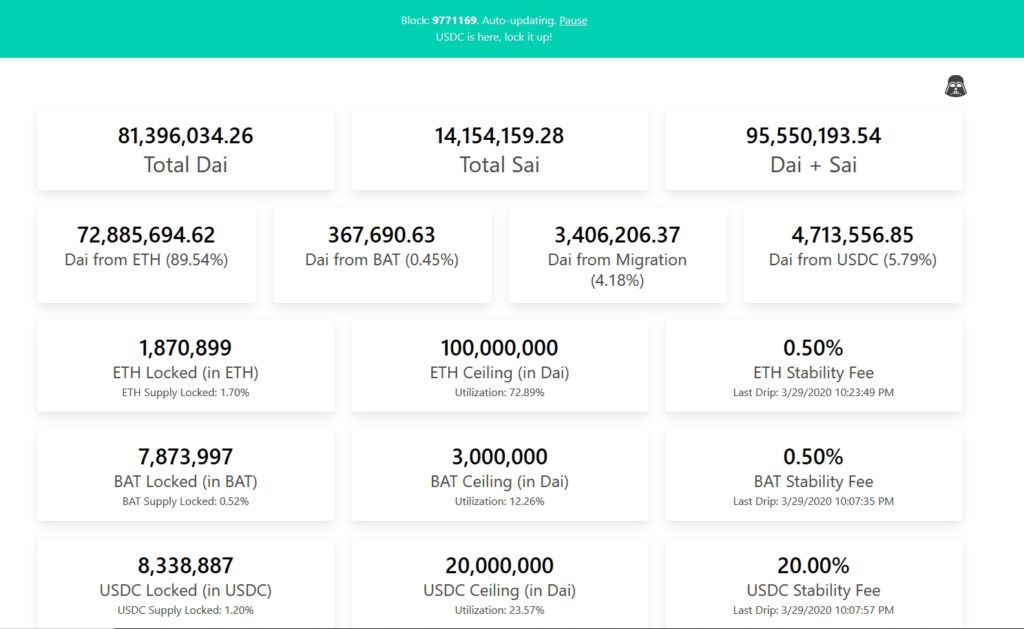

Dai Stats (Daistats.com)

Created by Mariano Conti, Dai Stats is a simple dashboard with analytics that provides statistics on the total DAI, total SAI, ETH locked in Maker DAO, current stability fee, collateral ratios, number of vaults open, Maker burn rate, and more.

The dashboard has been updated to also include statistics BAT and USDC which have been added to the Maker DAO protocol to assist with liquidity.

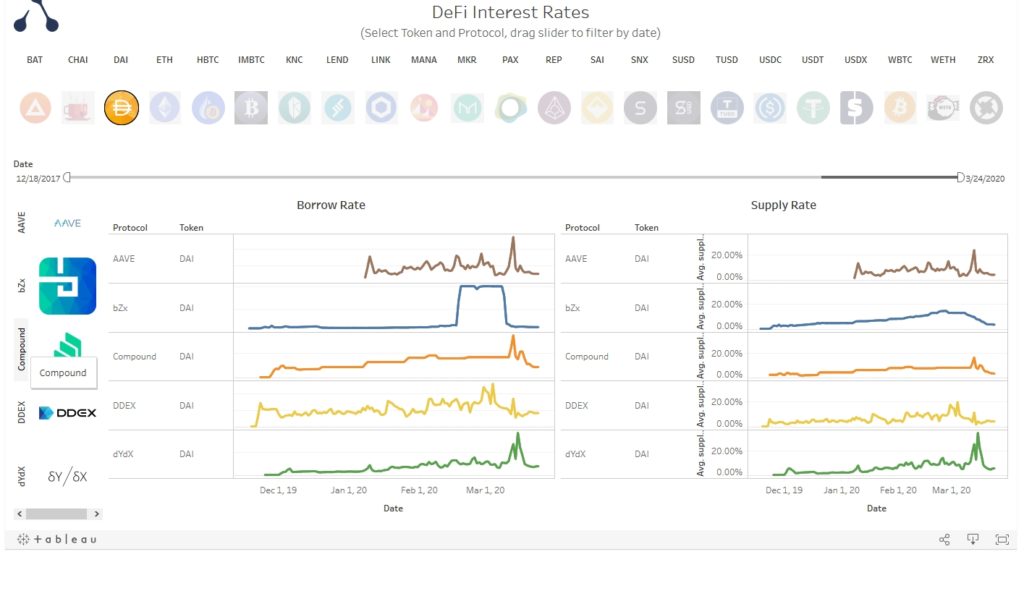

Alethio DeiFi Tableau Visuals (public.tableau.com/profile/alethio.defi)

Alethio has provided a dashboard of tableau visuals for the DeFi space. Visuals and charts include ETH locked in DeFi, Sai locked in DeFi, Synthetix overview, DeFi interest rates, Compound liquidity and others. The visuals are in tableau format which makes the visuals beautiful and customizable with sliders and filters.

DeFi Explore (defiexplore.com)

This is a great tool for multi collateral debt (MCD) details. The search function allows users to search by CDP ID, transaction, or address. A few of the stats provided include a list of the top CDP positions, total CDPs, DAI debt, and system system collateralization. DeFi Explore also has data on USDC and BAT locked in the protocol, both which are fairly new additions to Maker protocol.

DeFi Protocol Statistics and Visuals

Aragon Dashboard (scout.cool.aragon/mainnet)

Similar to the Set protocol dashboard, Scout also has a Aragon dashboard. Total organizations created, active organizations, daily votes cast, average balances (ETH, DAI, SAI) are a few of the high level visuals and charts available on this dashboard.

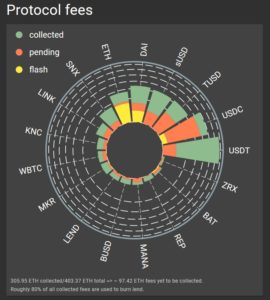

Aave Watch (aavewatch.now.sh)

Aave is an open source DeFi protocol for lending and borrowing digital assets including SNX, USDT, MKR, TUSD, ETH, ZRX, and others. This dashboard statistics include deposit interest rates, lending rates, available supply and borrowed numbers for each asset. Aave is also capable of providing flash loans which are captured on the Aave watch dashboard.

MKR Tools (mkr.tools)

Created by Mike McDonald, MKR tools is a analytics dashboard for the Maker DAO platform that tracks protocol statistics including CDPs transactions, DAI transactions, stability fees, and token data on DAI and MKR. The historical CDP visualization displays the collateralization ratio over time

As of 3/26/2020, this dashboard has not updated its API to track multi-collateral DAI. The statistics are only for single collateral DAI. For overall DAI stats that include MCD and SCD, refer to Daistats.com

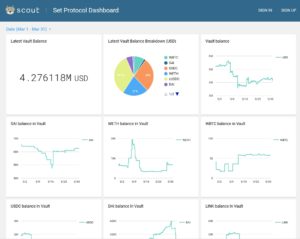

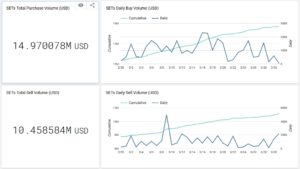

Set Protocol Dashboard (scout.cool/setprotocol/mainnet)

The Set protocol dashboard by Scout provides Set vault statistics and visuals. Visuals include the total vault balance and the vault balance breakdown by asset: WBTC, SAI, USCD, WETH, cUSDC, DAI, and LINK. The volume charts are very useful to reference when looking for cumulative sell and purchase, weekly re-balance, and 24 hour statistics. Transaction data, social trading set overview, and robot set overview numbers are also displayed in table format. Statistics can be filtered by specific dates. The official Token Sets website is best to use when looking for specific data such number of holders, traders per month, addresses, and direct etherscan links.

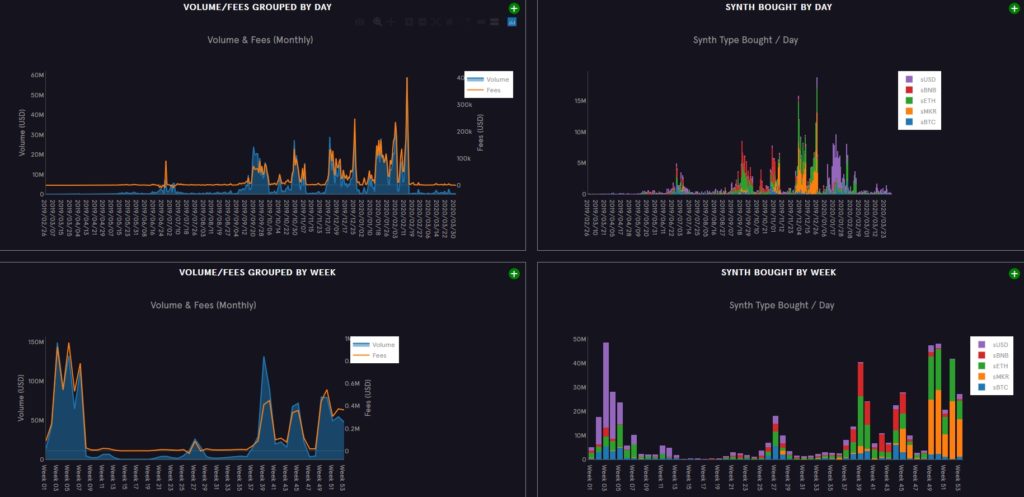

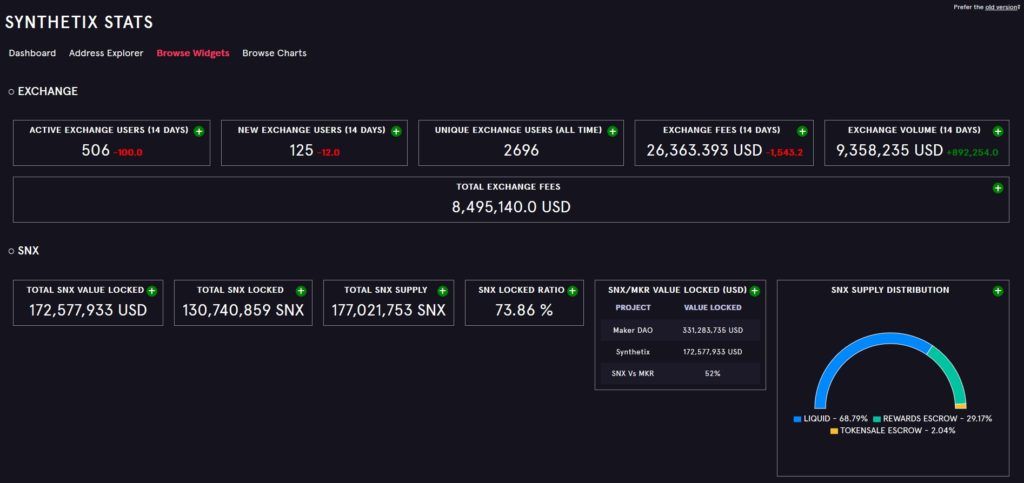

Synthetix Stats (synthetixstats.com)

This is a very cool, customizable dashboard full of charts and widgets for the Synthetix protocol. Widgets include statistics on active exchange users, new and unique exchange users, total SNX value locked, SNX supply, exchange wallets, top holders, and more. Charts include visuals on volume, fees, SNX purchases, , fees, supply, volume per address, asset distribution and more.

The official Synthetix dashboard is not functional as of 3/28/2020 so I would highly recommend Synthetix Stats.

Other Resources

Stats:

Bloxy Maker Dao Analytics – SCD only.

Coin Interest Rates – Borrow APR, lend APR, total borrowed, and market size statistics for Nuo, DyDx, MakerDAO, Nexo, Compound, and others.

Liquidity Pools – Liquidity pools stats for Uniswap, Curve, and Bancor.

Explorers:

DeFi Scan (DeFiscan.com) – Compound, Uniswap, and SpankChain explorer. Searchable by address or ENS name.

Whois0x (whois0x.io) – Ethereum block explorer that displays the address balances, ERC20 tokens, collectibles, DeFi positions.

Coinresources Relevant Articles:

Decentralized exchange data and visuals (coming soon)

Stablecoin data and visuals (coming soon)

Suggestions? Contact me on twitter @realvivek_