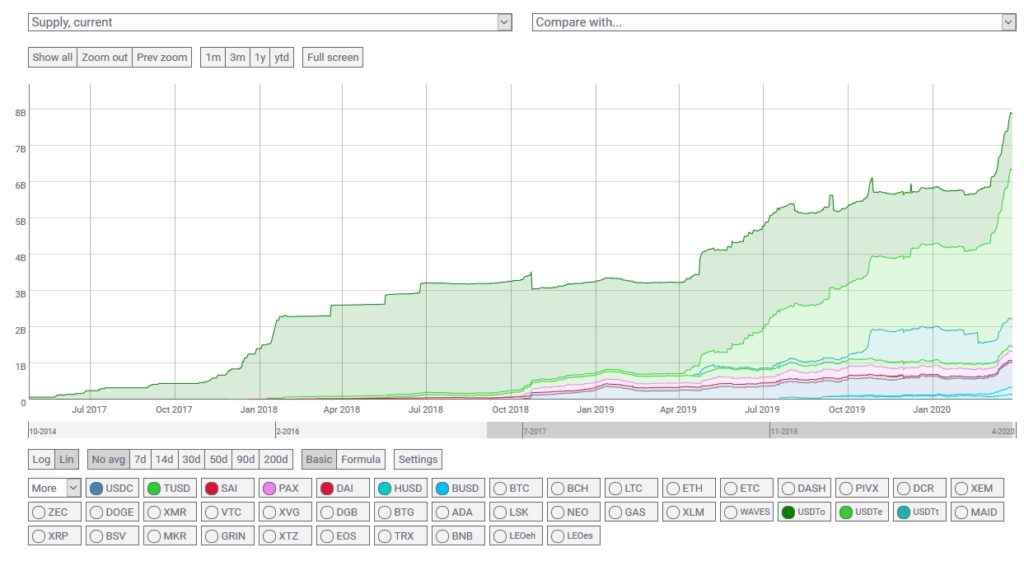

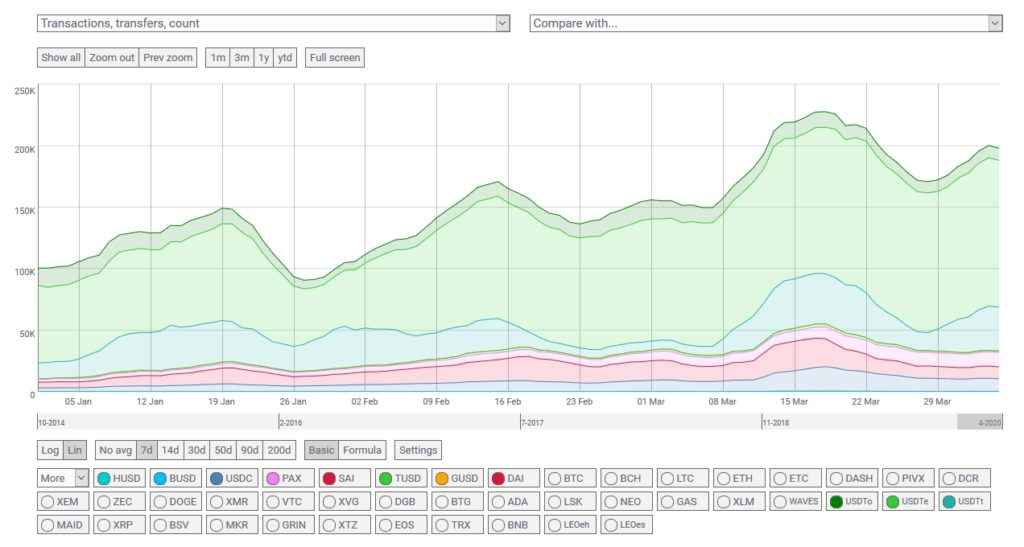

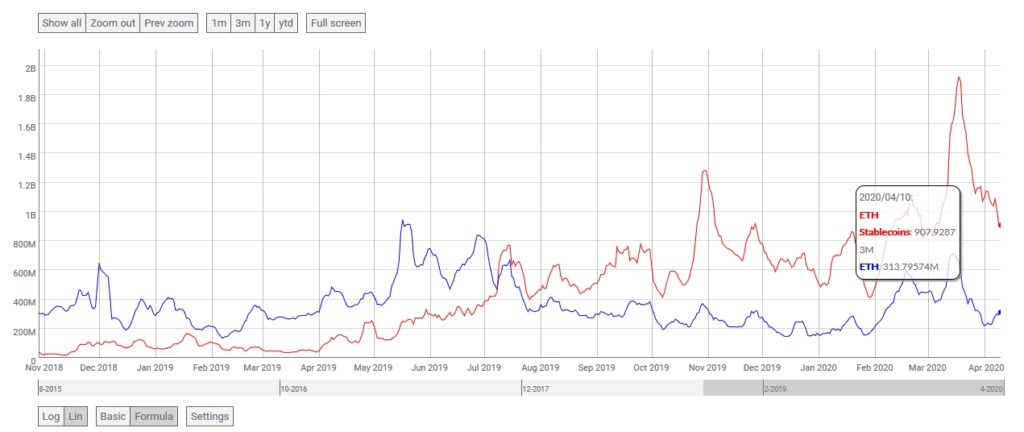

Stablecoin growth has sky rocketed over the past couple of years. The aggregate stablecoin supply at the peak of the Bitcoin market in late 2017 was under $1.5 billion. Today the aggregate supply is over $9 billion spread out over various networks, not just Ethereum. The demand for stablecoins has further increased since the “Bitcoin Black Thursday” sell off on March 12, 2020. The growth has been so large that stablecoins on Ethereum account for more than 70% of the daily transfer value on the Ethereum network. With over $9 billion stablecoins issued, the IMF, Bank of International Settlements, and the Financial Stability Board have all taken note.

The IMF blog actually seems to understand the risks and benefits of these stablecoins quite well, their recent comments on the benefits:

The strength of stablecoins is their attractiveness as a means of payment. Low costs, global reach, and speed are all huge potential benefits. Moreover, stablecoins could allow seamless payments of blockchain-based assets, and can be embedded into digital applications thanks to their open architecture, as opposed to the proprietary legacy systems of banks.

Currently, the dominant use case for these stablecoins include:

- Traders moving in and out of crypto positions on exchanges.

- Cross border settlement.

- Global liquidity.

- Hedging positions or reducing risk by moving from Bitcoin to USDT or USDC.

- Earning high interest rates on deposits on platforms such as BlockFi.

- Using Bitcoin or Ethereum as collateral to take out loans in stablecoins.

- For countries with high currency volatility, parking money in stablecoins may provide better stability.

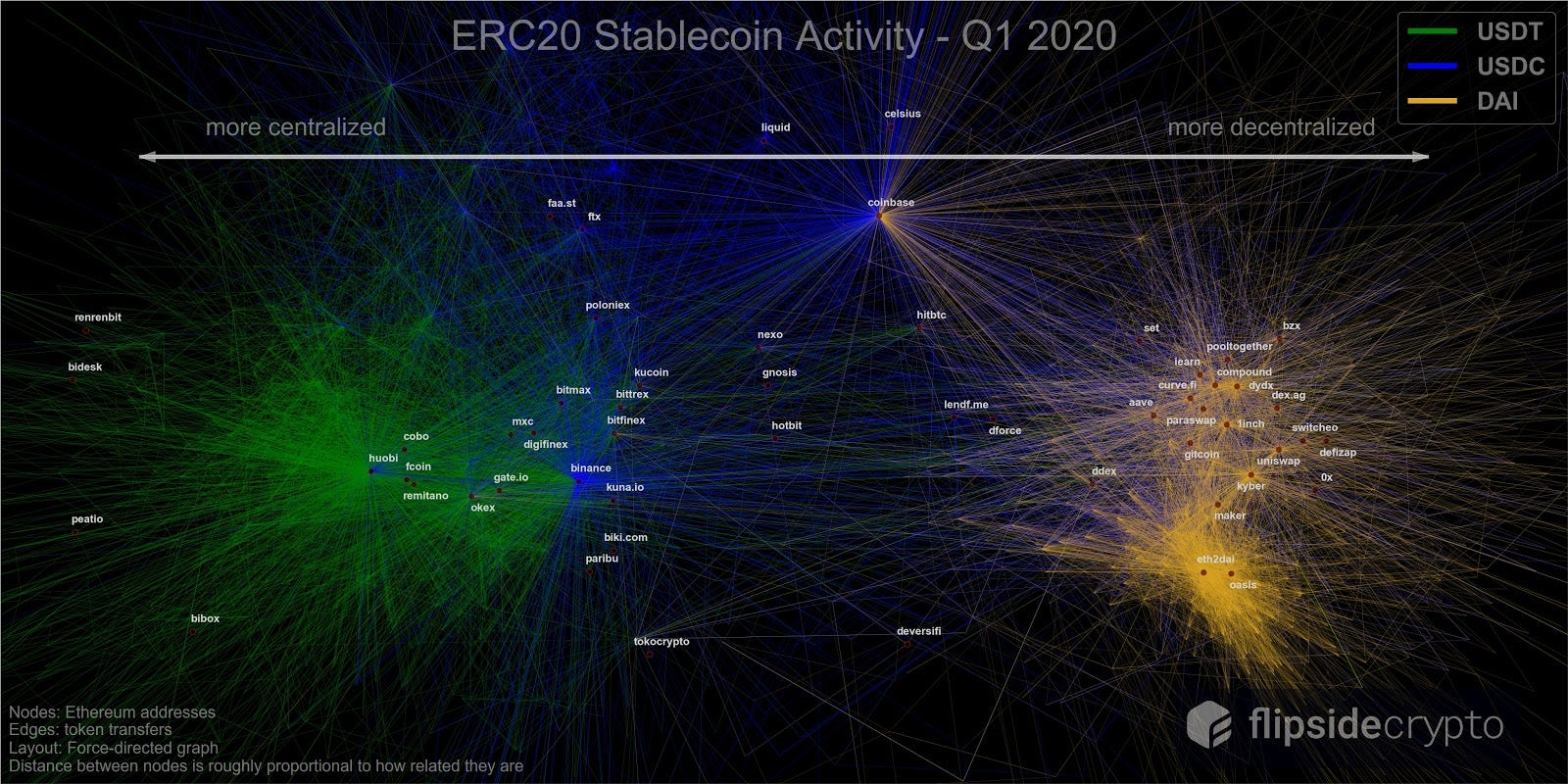

- OTC flow from Asia (mainly USDT).

The three largest stablecoins are USDT, USDC, BUSD, and DAI. USDT, USDC, and BUSD are pegged to the U.S. dollar and should backed with a 1:1 ratio for every USDT or GUSD printed. DAI, however, is backed with a crypto collateralized loan through the Maker DAO protocol. From the recent Flipside study, USDT was mainly found to be used for arbitrage on Asian exchanges while USDC is mainly held in regulated exchanges and centralized lenders. DAI, however, is dominant in DeFi protocols.

Below are my favorite, go-to resources to track stablecoin growth, activity, market and exchange information. These include API’s, charts, and excellent visuals that assist in analysis for traders and investors. This page will be continuously updated to add additional resources as they emerge.

Most of these resources can be found on the main dashboard under the stablecoin category. This post was last updated on 5/10/20 and will be continuously modified to add the latest and greatest resources for stablecoins. Ping me on twitter @realvivek_ with any recommendations or feedback.

Block Explorer Data

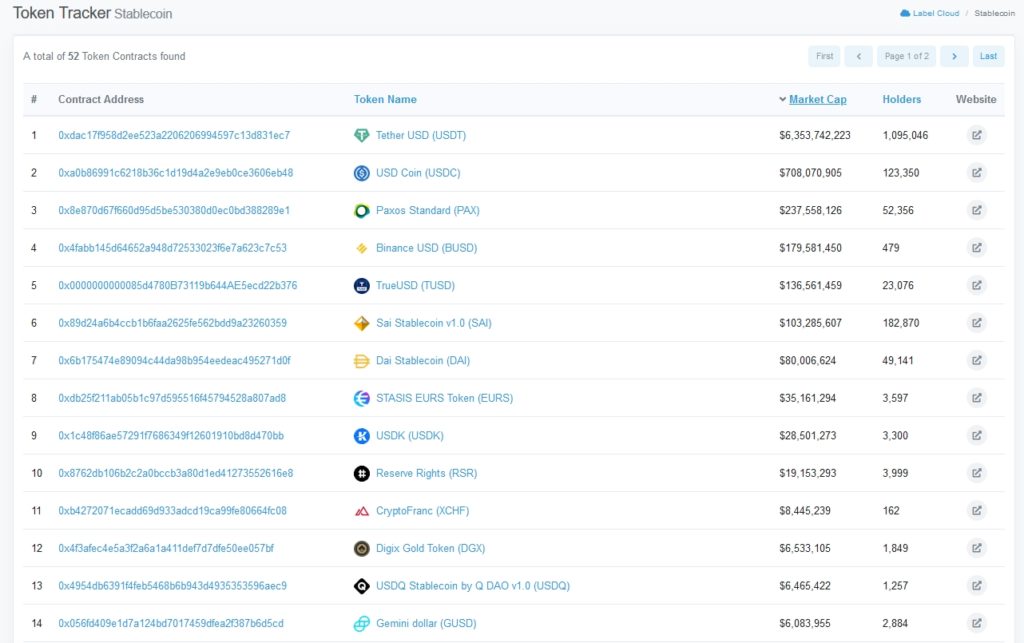

Block explorers should be a the number one resource when analyzing on-chain data or looking for API end points. Etherscan is an excellent resource when looking to verify the actual smart contracts for stablecoins deployed on Ethereum. Etherscan not only provides the read and write contracts but other analytics including exchange data, wallet history, currency pairs, DEX trades. With the majority of the large stablecoins on the Ethereum chain, it’s very useful to use a block explorer to directly view the data and compare it other data providers for accuracy. Start with the token tracker for an overall summary.

Etherscan token tracker for stablecoins

Individual stablecoin contract links:

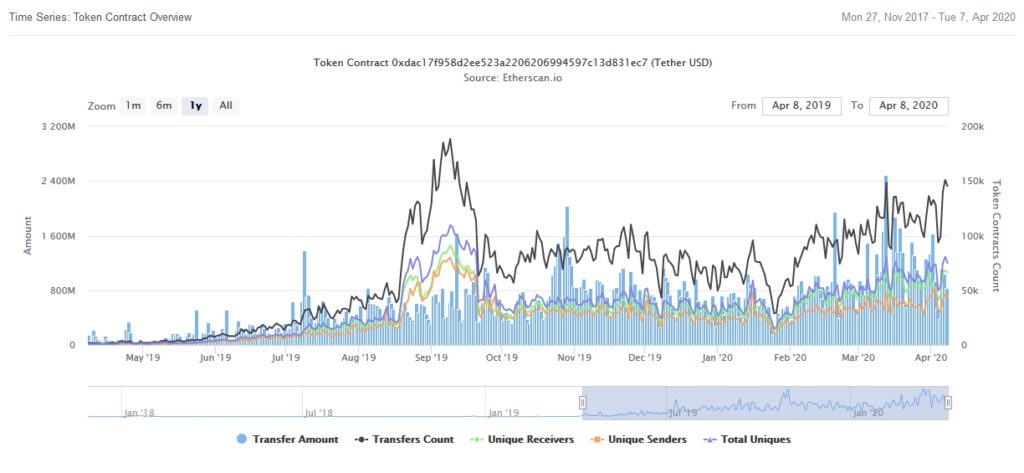

Tether Data

Tether dominates the stablecoin space, currently 10x larger in market capitalization than the next competitor. It’s deployed across multiple chains and platforms such as Ethereum, Omni, Liquid, EOS, and Tron. Below are direct, transparent, resources into each of those public chains. This data (and others) can be found from the official Tether transparency page.

USD₮ and EUR₮ issuing address on Omni

Who’s holding USD₮ on Omni

Ethereum Contract: USD₮, EUR₮, CNH₮, XAU₮

Tron Contract: USD₮

EOS Contract: USD₮

Liquid: USD₮

Algorand Asset: USD₮

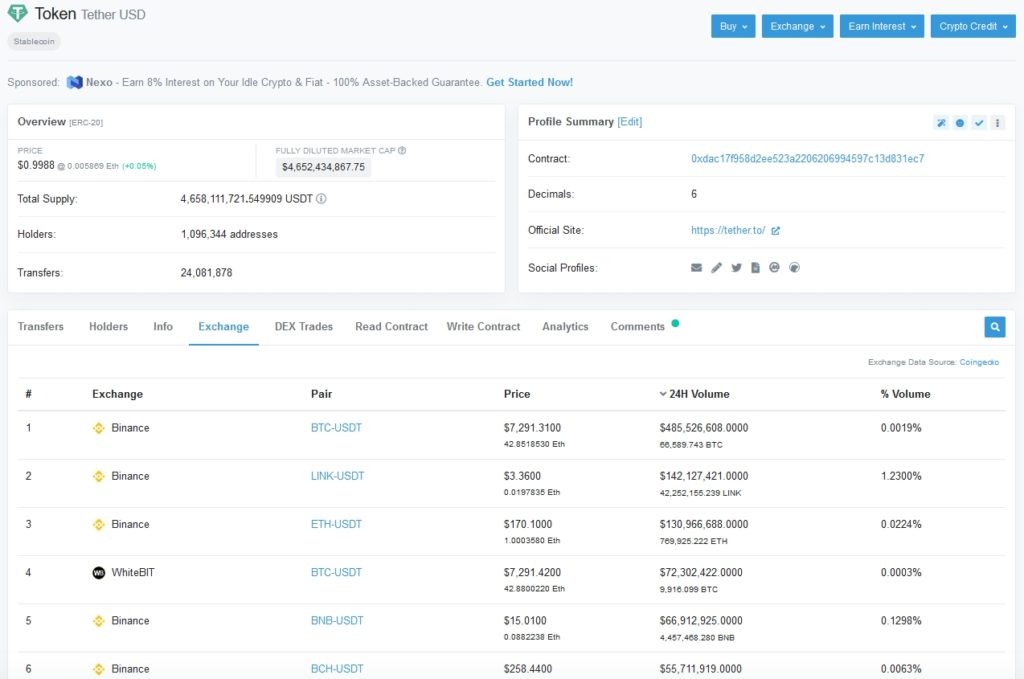

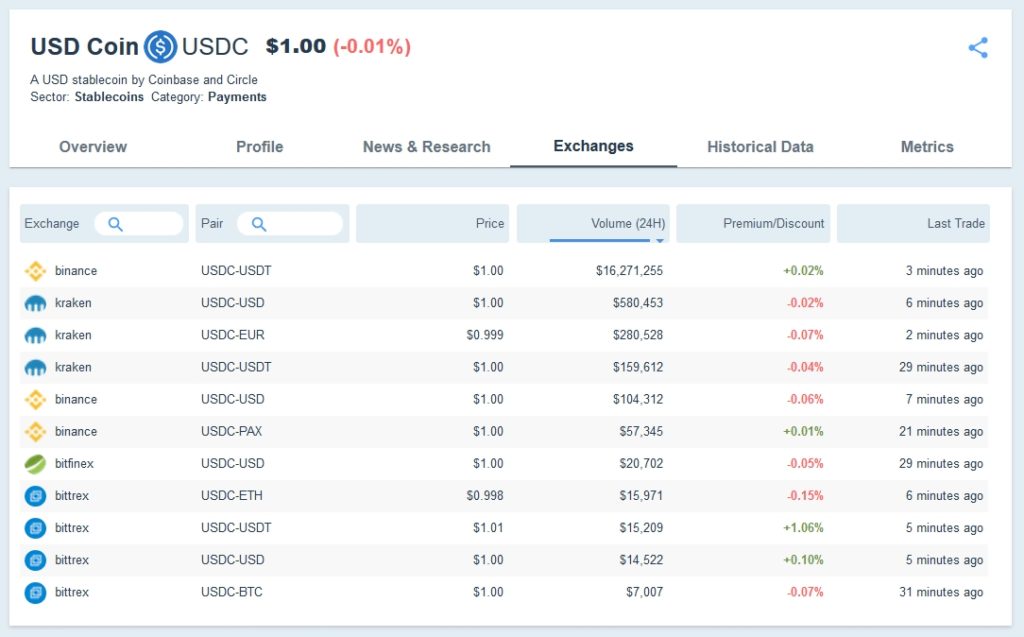

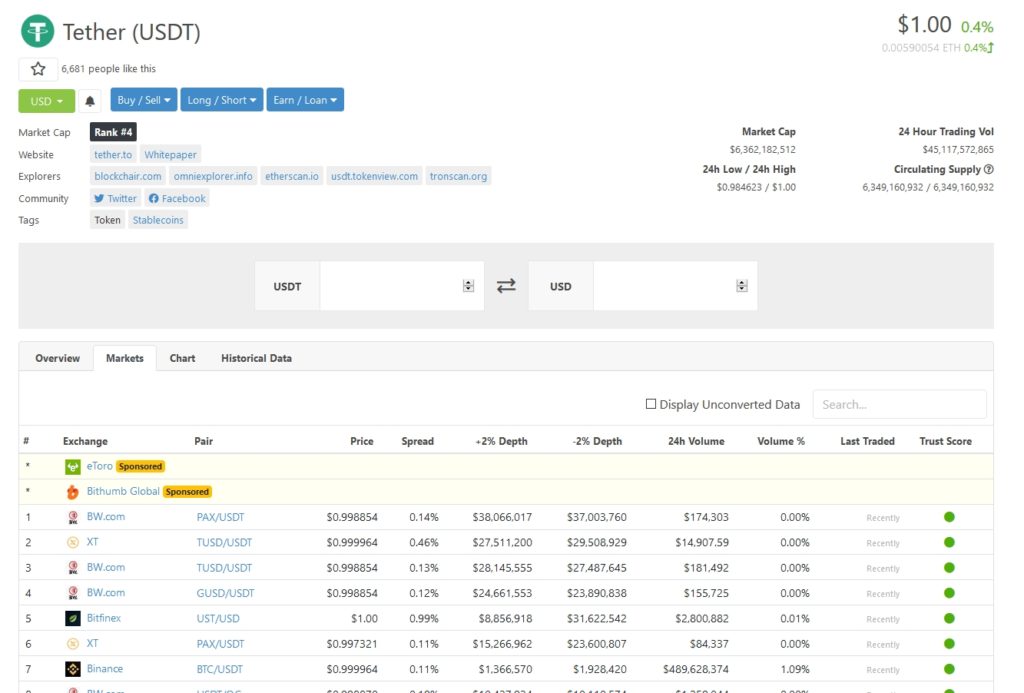

Market Data

Stablecoin market data can be found on a variety of places online. Some more accurate than others, hence it’s always prudent to verify the on-chain data itself when applicable. I find these resources below to be consistently accurate for stablecoin activity on exchanges. Information including exchange pairs, volume, deposits, withdrawals, and daily movement are just a few of the metrics available to end users.

Coin Gecko Stablecoin Market Data

Coin gecko allows users to filter stablecoins out of their complete cryptoasset list using the stablecoin tag. From there, users can sort and view individual pages for over 20+ stablecoins. Information includes market cap, market cap dominance, trading volume, exchange spreads, low and high data, and more.

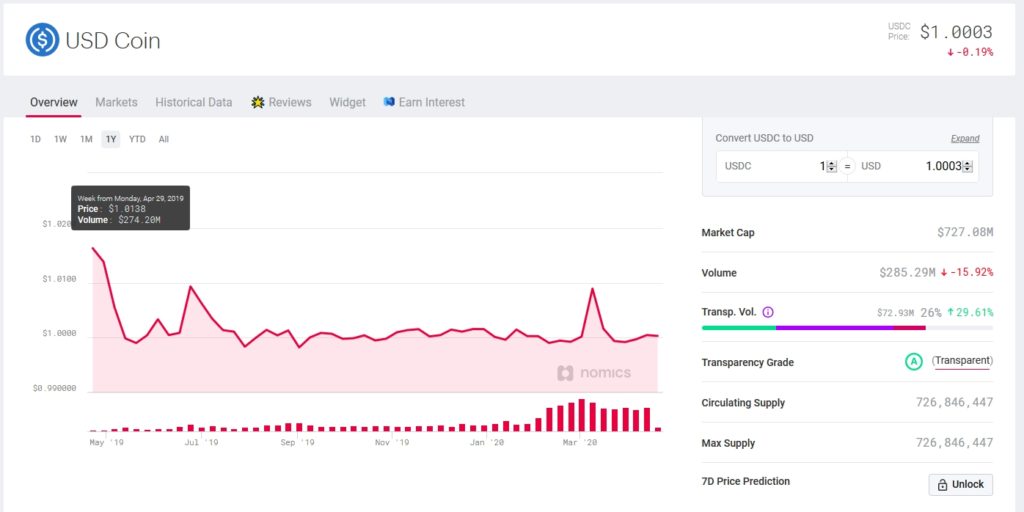

Stablecoin Price

One of my favorite links, the Coin Metrics stablecoin price provides a snapshot on USD backed stablecoins and their peg status.

Santiment provides an excellent dashboard for tracking market and on-chain activity. When it comes to stablecoins, the dashboard provides token metrics including circulation, age consumed, volume, and velocity. Exchange flow balance (inflow + outflow), deposits, top holders, percent of total supply on exchanges, and daily active deposits are just a few of the metrics available on this extensive dashboard.

Viewbase

The Viewbase cryptoasset dashboard provides exchange wallet data and exchange holdings comparison charts. Supply on exchange wallets, circulating supply, total supply, amount of tokens in exchange wallets, and top exchange wallet transcations are the main metrics from Viewbase. It’s easy to see that Binance and Huobi hold the majority of USDT.

On Chain Data

Coin Metrics is the go to data provider for public blockchain metrics, especially for stablecoins. Metrics include price, addresses, transfer value, supply, and many more. Data can be visualized with the charting tool or accessed through their free API. The advanced charting tool is great for more experienced analysts looking for custom analysis. The team has a thorough process for some of its industry leading metrics including adjusted volumes, free float supply, and transaction values. The weekly newsletter is also highly recommended.

Data for the following stablecoins are available through Coin Metrics:

- Tether on Ethereum

- Tether on Omni

- Tether on TRON

- USDC

- TUSD

- SAI + DAI

- PAX

- HUSD

- BUSD

- GUSD

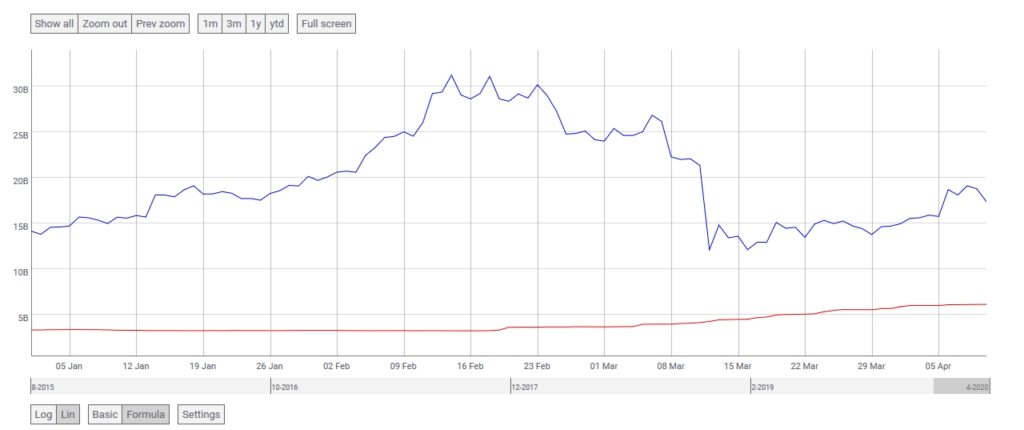

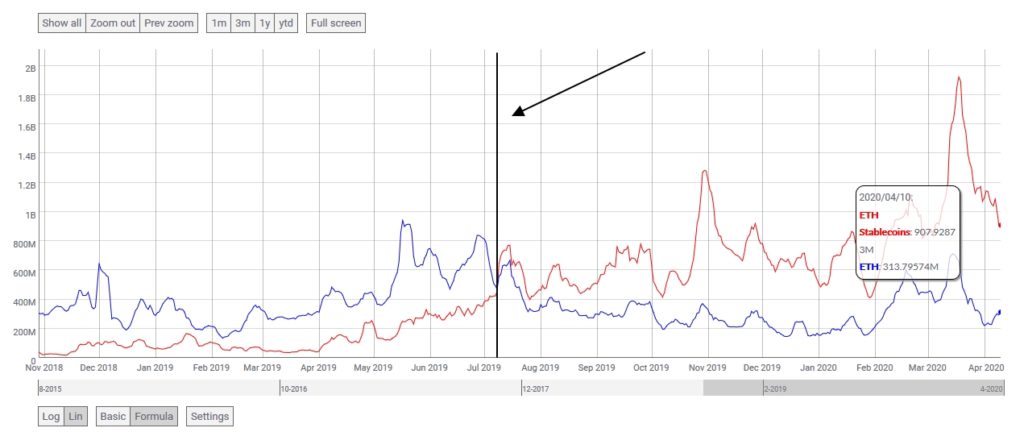

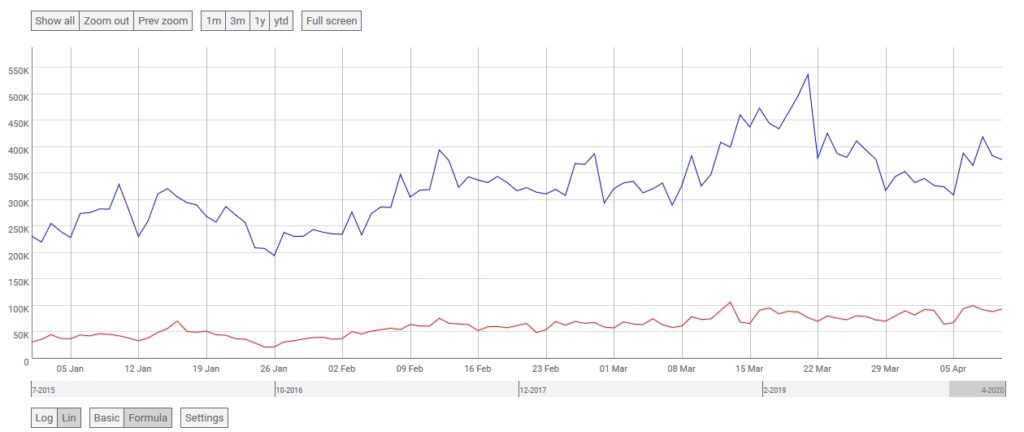

Stablecoin active addresses vs ETH

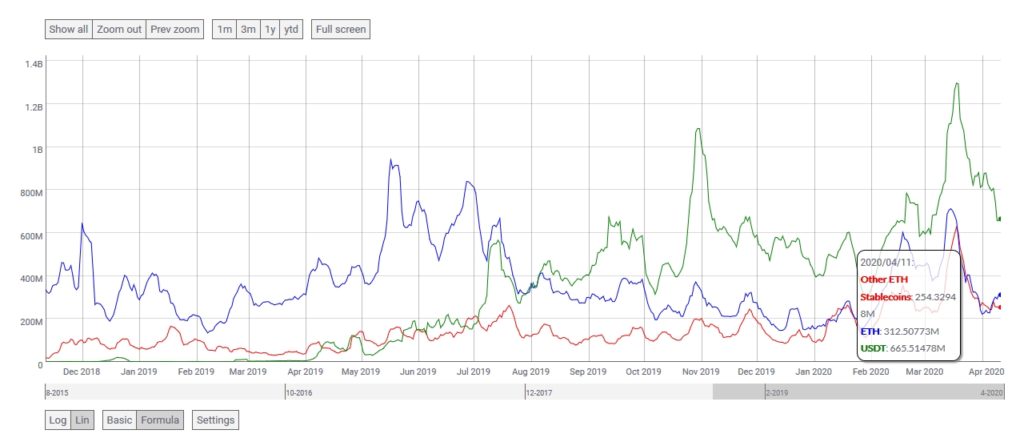

A comparison between Tether, the “other” stablecoins, and ETH total transfer value

Twitter Bots

- Maker DAI Bot – Provides alerts when vaults are opened, closed, re-paid, and 24 hour summaries of the network with minted, burned, and current DAI supply metrics.

- Whale Alert – Similar to the tether printer bot, whale alert tweets treasury block explorer links every time a large number of stablecoins are minted.